The bull market in U.S. stocks is now nine years old, one of the longest such streaks in history. The United States boasts many of the world’s most valuable companies, and investors have enjoyed high returns with low volatility.

Yet there’s reason to wonder whether U.S. capital markets, broadly considered, are as healthy as they look. We asked this question two years ago and return to it now, with a little more data, a few more answers, but still many outstanding puzzles.

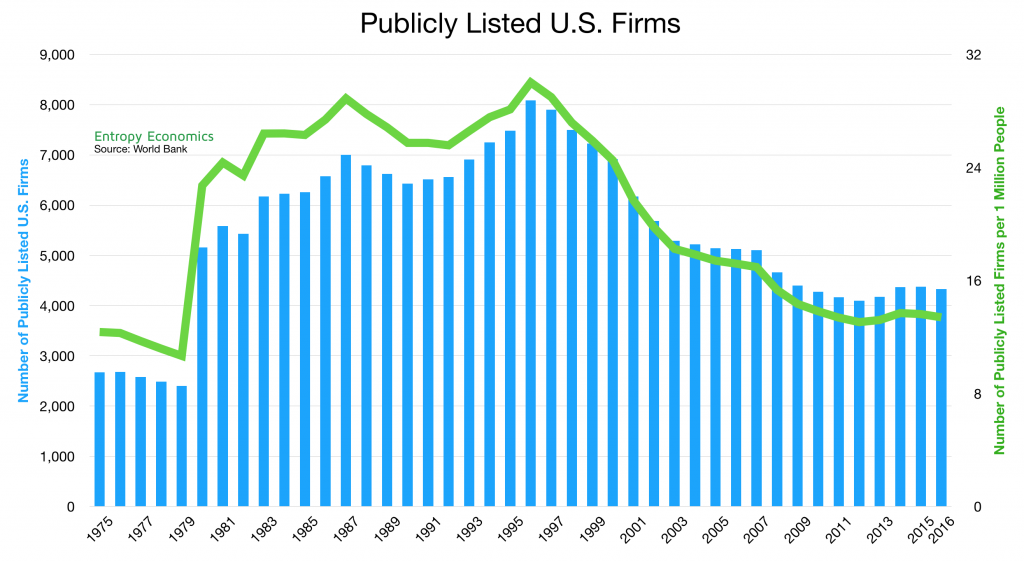

The number of publicly listed U.S. firms, for example, is just one half what it was in the mid-1990s. Depending on the type of listings counted, the number of U.S. public firms has fallen to a range of 3,500-4,000 today from a range of 7,500-8,000 in 1996. Adjusted for population, the number of publicly listed firms has dropped to 13 per million people from a peak of 30 per million. continue reading . . .