See our latest research, in collaboration with the venture firm High Alpha: Startups and the Remaking of the Firm

On February 5, in San Francisco, Elliott Parker of High Alpha presented this new research at Alloy, a conference focused on corporate innovation. This research takes the famed Innovator’s Dilemma to the next level. It suggests corporate concentration has peaked, argues that firm borders are evaporating, highlights the diminishing returns of traditional R&D and M&A, and shows how big firms might harness the unique strengths of startups to transform and grow.

A few excerpts:

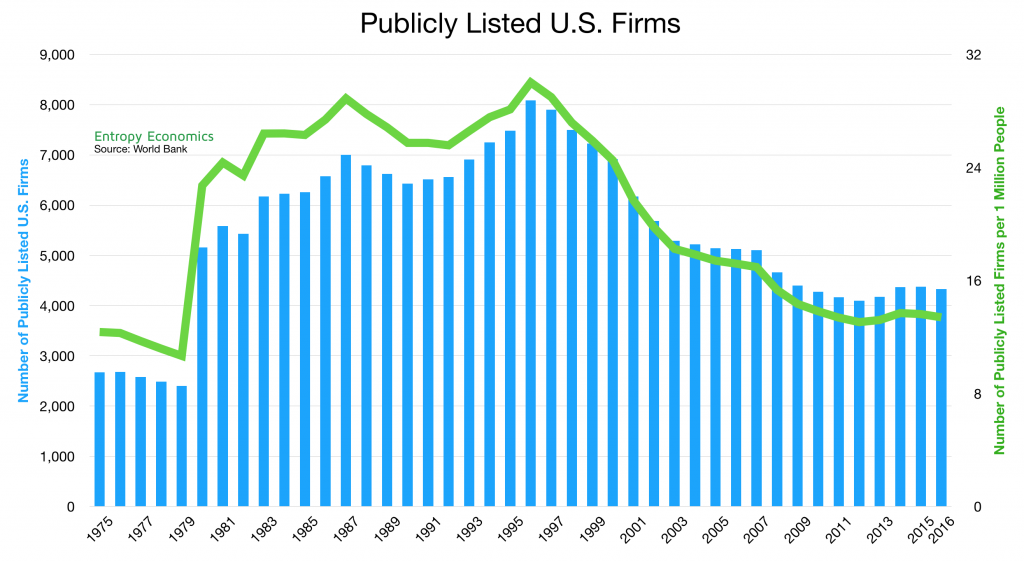

“The dominant business story of the coming decade will be the disaggregation of the firm. After reaching a peak of corporate and industry concentration, the undeniable forces of technology have unleashed a new phase of decentralization . . . Today, thousands of smart people at hundreds of important companies are spending millions of hours and billions of dollars to advance an illusion of innovation. The evidence can be seen in the individual challenges of big firms and the macroeconomic data of a pronounced productivity slowdown in the traditional industries, which make up 70 percent of the economy . . .”

” . . . Only startups can reimagine and redeploy resources – money, technology, and, most importantly, people – to the radical degrees required. Only startups can learn fast enough, discover new products and markets cleverly enough, incentivize and coordinate talent effectively enough, and deliver real value under constraints jarring enough to achieve breakthrough innovation. That’s great for startups, but where does that leave big firms? In better shape than one might think – but only if the big firms recognize this shift and aggressively exploit it.”