See our latest in The Hill: The Microchip Renaissance Needs More Than Money

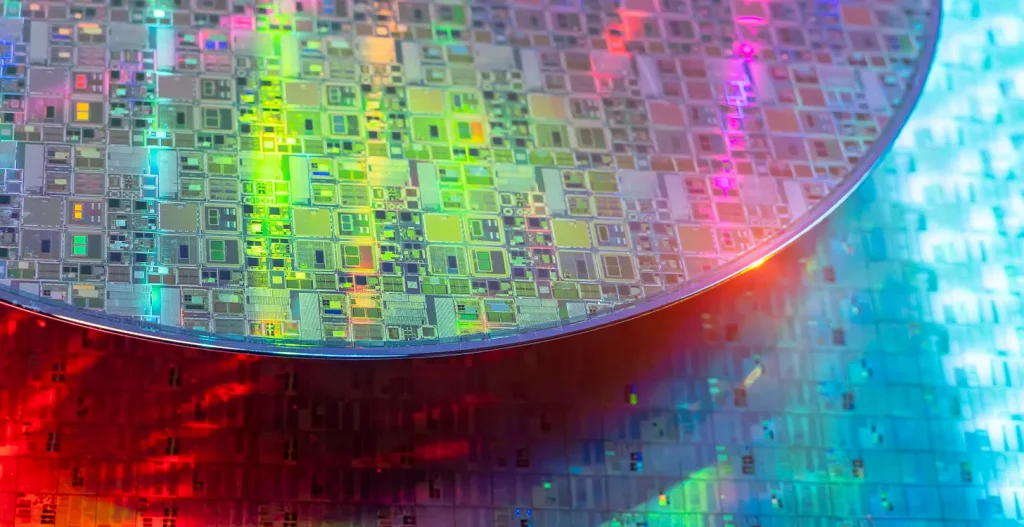

“The United States is pouring money into microchips, but will this fix the supply chain problem? The newly-passed CHIPS Act provides more than $75 billion for advanced fabrication of microchips in the U.S. and is the centerpiece of a strategic effort to boost domestic high-tech manufacturing.

“Money alone, however, is not enough. If policymakers don’t correct an array of obstacles across the high-tech supply chain, the CHIPS effort and America’s broader high-tech manufacturing strategy could falter.

“Over the past four decades, most of the world’s advanced semiconductor manufacturing capacity gravitated to Taiwan and nearby Asian locales, while the U.S. share of leading-edge capacity fell to around 12 percent. Low-wage labor was a factor, but enormous government subsidies were more important. Now, China and India are pushing additional subsidies and further undercutting the U.S. on a host of industrial regulatory burdens…” continue reading at The Hill . . .